Financial Aid Eligibility and Withdrawing from Class

Withdrawal from Courses

A student may officially withdraw from a course without academic penalty through the ninth week of classes during the fall and spring semesters; through the third week for the Summer Session; and through the first week of the Winter Session. Please review the Academic Calendar for exact dates and deadlines in the Course Schedule Booklet or online at www.mec.cuny.edu/registrar. When contemplating withdrawal from courses, the student should bear in mind that academic standing or eligibility for financial aid may be affected. Failure to adhere to the procedures for withdrawing from courses will result in “WU” grades.

The City University of New York has mandated that all remedial courses be completed within a student’s first year of college. Withdrawal from Remedial Skills courses will not be permitted without the approval of the Director of the Freshman Year Program, the Chairperson of the English Department, Chairperson of the Math Department or Chairperson of SEEK/Special Programs.

For students withdrawing from the 4th through the 8th week, a grade of “W” is given, which is not counted in computing the GPA. Grades of “Z” are given by the Registrar’s Office only.

Financial Aid eligibility is established on the 7th day of the semester.

Unofficial Withdrawal from Class

Students who cease to attend courses without officially withdrawing are given a grade of “WU”. Grades of “WU” are counted as “F” grades. “WU” grades can be appealed by filing a petition through the Student Advocacy and Support Services Center which is reviewed by the College-wide Committee on Academic Standards and Regulations. All appeals must be accompanied by substantive documentation. All such appeals will be presented to the Committee for approval or denial. The student is subsequently notified of the decision by the coordinator of the Committee.

CUNY Updated Grading Memorandum

Withdrawal Effects on Financial Aid

If a student completely withdraws from school during a term, the school must calculate according to a specific formula the portion of the total scheduled financial assistance the student has earned and is therefore entitled to receive up to that point in time. If a student receives (or the College receives on the student’s behalf), more assistance than the student has earned, the unearned excess funds must be returned to the U.S. Department of Education. If, on the other hand, the student receives (or the College receives on the student’s behalf) less assistance than the student has earned, the student may be able to receive those additional funds.

The portion of the federal grants and loans a student is entitled to receive is calculated on a percentage basis by comparing the total number of days in the semester to the number of days completed before the student’s withdrawal. For example, if a student completes 30 percent of the semester, the student earns 30 percent of the assistance he/she was originally scheduled to receive. This means that 70 percent of the scheduled awards remain unearned and must be returned to the federal government. A student has to complete more than 60 percent of the semester, in order to earn all (100 percent) of the scheduled assistance. If a student withdraws (either officially or unofficially) before this point, the student may have to return any unearned federal monies that may have already been disbursed to the student.

The College shares responsibility with the student for any excess funds, which must be returned. The College’s portion of the excess funds to be returned is equal to the lesser of:

- the entire amount of the excess funds, or

- the student’s total tuition and fee charges multiplied by the percentage of the unearned funds.

If the College is not required to return all of the excess funds, the student must return the remaining amount. Any loan funds that are returned by the student must be paid according to the terms of the promissory note. If a student returns any grant funds, the law provides that the amount to be repaid is reduced by 50 percent. This means that a student only has to return half of any excess funds received.

Any amount a student returns is considered a federal grant overpayment. The student must either return that amount in full or make satisfactory arrangements with either the College or the Department of Education to repay the amount. These arrangements must be completed within 45 days of the date of the College’s notifying the student of overpayment. Any student failing to do so risks loss of eligibility for further federal financial assistance.

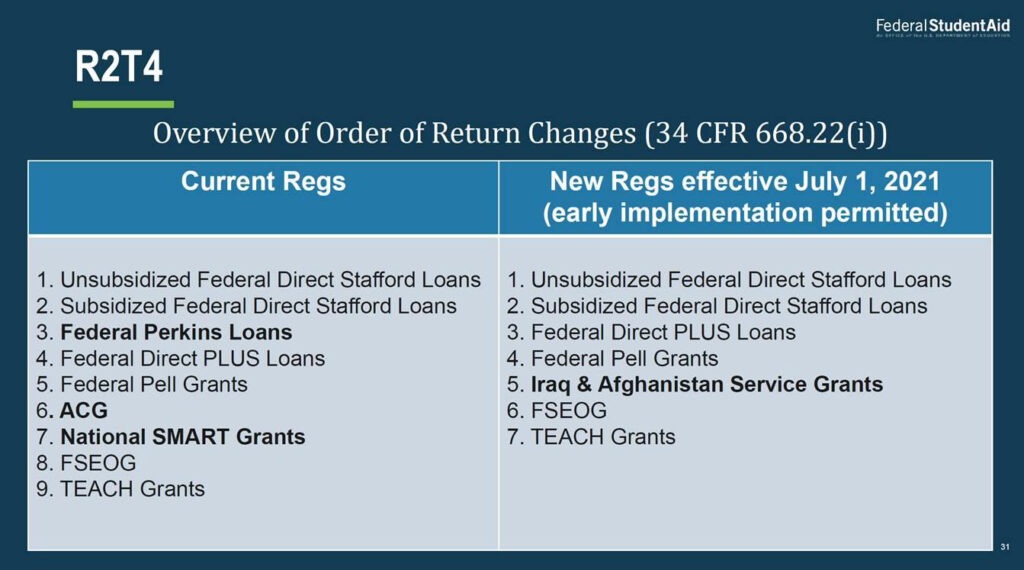

Note: Effective 7/1/2021, per CFR 34 668.22(i)- the order of returns has been changed. See below.